Been a while since I’ve run a crypto article, but given it is my favorite nefarious figure getting pole axed and the opportunity to recycle my favorite past art, I thought I would trot out a quick article. Basically this one should be considered as one of a series starting here:

here:

and here:

Anyhow, I was originally asked to comment on FTX’s spectacular collapse, to which I replied with this screenshot:

Ironically this is pretty much exactly what happened.

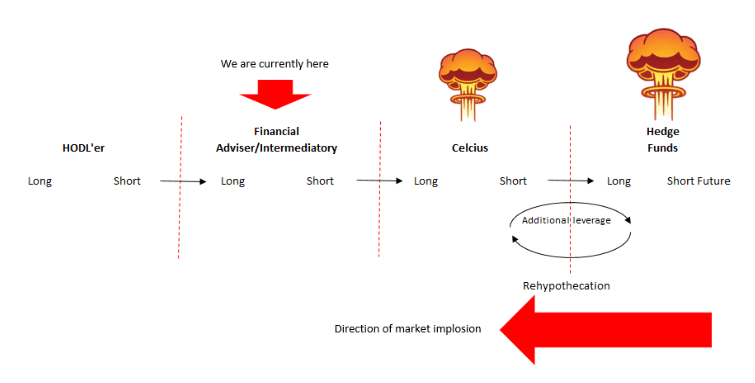

Remember this diagram that I drew way back at Christmas?

Well it is basically just another example of the liquidity crunch continuing to move up the hedge fund chain, and once again will overwhelmingly result in retail punters getting a kick to the nuts.

The fundamental driver is the liquidity crunch that arose within the Dildo’s financial empire following Alameda and FTX rising to become the saviours of Crypto back in May or so of this year.

Remember this story? “Alameda Bails Out Voyager Digital on News of 3AC Exposure” with Alameda bailing out Voyager, who was one of the main casualties of 3AC? You could not assemble a bigger daisy chain of dildos and fall guys.

Although by August the headline had changed to “Sam Bankman-Fried’s crypto firms had deep ties to Voyager Digital and its bankruptcy wipeout“

So SBF went balls deep into Voyager and the whole 3AC, and while initially acclaimed as the saviour of crypto what he was doing was becoming stuck to beasts already trapped within the bottomless tar pit that stretched back to Luna’s implosion and the daisy chain of disasters that followed.

I don’t know why he chose to involve Alameda in with those doomed creatures – pure hubris maybe? Perhaps he thought the same rough shod rules that existing in crypto, where if something implodes everyone just walks away, somehow applied in the real financial world involving hedge funds, etc. It is very easy to take on unknown liabilities in these sort of fluid liquidity situations.

Whatever the reason Alameda is one of the main liquidity providers in Crypto, it couldn’t be allowed to fail or be ceased – it would mean cutting off access to SBF’s rivers of gold. The ability to respond in advance to liquidity movements in the market.

So FTX rode to the rescue, using FTT.

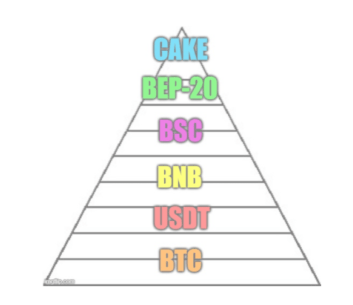

So what was FTT? From what I can tell FTT was FTX’s exchange token – much like Binance token runs as the base token on Binance exchange, and the importance that these base tokens have in terms of the liquidity pyramid that other tokens that are built on top of it:

This is Binance coin’s various token liquidity pyramid, I imagine FTT was used for much the same.

One of the problems if Alameda blew up then their collapse would have ensured the liquidiation of all the FTT tokens that would have vested in September of this year. Vest – who could they possible vest too?

Had Alameda collapsed and the FTT’s vested to Alameda then it would have been a disaster. The whole point of crypto is controlling liquidity to ensure prices can be controlled – uncontrolled liquidity dumped all at once would ruin them all – like Luna had done.

Which is what has been suggested by some suspicious FTT token transfers back in September, according to various internet sleuths there was 173m FTT’s sent from the original FTT ICO to Alameda (where they would have become creditor funds had it gone under) and these were released on the vesting date. “Alameda” then immediately sent them back to FTX.

So here is the likely driver behind SBF getting in this position – FTX loaned Alameda the funds it needed to avoid the immediate effects of its liquidity crisis that arose following Luna’s crash back in May/June. SBF did this via his left hand with Alameda by using the FTT that were going to vest to Alameda as collateral for the loan from SBF’s right hand, FTX – hence the round trip in FTT on vesting date.

Better FTX loan Alameda the funds and collect the FTT, rather than allow Alameda to collapse and the FTT then vest to the creditors, who would have potentially dumped it in an uncontrolled fashion onto the market. This would have lead to a liquidity cascade back to FTX, because the FTT it was now holding as as a large part of FTX’s balance sheet. Meaning that independent of any loans to Alameda, its capital base would have been rendered worthless. By round tripping the loans, he simply drew the inevitable out a little longer – most likely by using FTX’s own customers funds, that it has effectively loaned to Alameda, in the hope that markets recover and he can turn it around.

Trouble is there is a high likelihood that there were a lot of eyes on this transaction of FTT back in September, those eye obviously include CZ. I’ll mock that Soyboy SBF, but while I will call CZ a crook and someone who I wouldn’t trust as far as I could throw him, I wouldn’t call him a fool or an idiot (SBF isn’t either, but imho he was out of his league against CZ).

Anyhow, the past couple weeks a fair bit of supply of FTT has been bleeding out into the market, which along with unconfirmed rumours has been depressing the price. Over the weekend all it took was CZ to make a couple lazer like remarks to create a selling cascade in the thin weekend liquidity which basically brought SBF’s empire to its knees. This moment has really been inevitable since the moment SBF, in his hubris, involved himself in the Luna tar pit.

…there is a four dimensional chess play to this though. Maybe SBF knows crypto as a ponzi scheme is finished, regulators are going to crush it and economics are going to ensure most coins return to their intrinsic value, which in most cases is nothing. Given his problems he has in passing his exchange business over to Binance…. it could leave CZ either the crypto winner, or simply the biggest bag holder of all. Perhaps this is all about using the last of the available exit liquidity?

If that is the case, then I will return to this screenshot…

Postscript: Even further amazing was CZ catching everyone by surprise and pulling out of the take over of FTX that he’d agreed on only the day before. Perhaps he saw the 4D chess move – either way he is ruthless. It was a masterful coup de grâce to an already mortally wounded opponent.

OT but looks like ru is withdrawing from kherson without a fight right now. i feel it is highly possible now they are going to lose this war. i don’t know how to assess the information. i think coming might have been right now, but we will see what happens over the next day and coming months when the mobiks arrive. but i am increasingly skeptical the kremlins have the heart to continue this conflict.

i did say there was a distinct possibility of kherson withdrawal, though it is interesting it seems to have occured with little to no actual fighting. but at the moment i would say this is does not bode well whatsoever. but why this is happening to me is still unclear.

and by heart i mean i don’t think they have been willing to make the hard decisions given the situation required to efficiently win it. something i thought they could do initially, slowly, but even after the mobilisation there will be more waves of mobilisation required, and if kherson is abandoned (even if the city is completely empty) this will be a gargantuan political loss. one that may be unrecoverable for this conflict and putin’s entire regime. i concede i may have been wrong.

The Duran and Gonzalo Lira had some good clips about this.

Russia moved 30,000 troops back, 5,000 piece of hardware and artillery and even some Russian monuments without any casualties…

Don’t know how to read that but I doubt it is a loss for now, all the troops are still healthy and able bodied.

One thing that strikes me about this was is the hyper awareness of every event. Libya, Yemen, Syria and before it Iraq and Afghanistan did not have this level of detail… an army pulled back to a fortified position across from a river. Let’s see what happens

Where are all our fucking crypto shills at ?

bjw? Peachy ? Robert?

get in here

cryptos done, when DLS turns out to be ahead of the curve you know you’ve fucked up

This is a scam finance problem, not a crypto problem per se.

Agree. If crypto is such a scam, then why all the talk of CBDC?

https://twitter.com/jonwu_/status/1590099676744646656?s=46&t=B6YxSfAfCHgpfuSJ38O_l1iNPvpEXsO0pfAdoPc_2sk

https://amycastor.com/blog/

It should be obvious that anyone called “bankman-fried” is stealing from you

just really mind blowing that he was basically admitting all along that this is what he was doing

at least tether provides a constant stream of implausible lies

RIP dear hodlers

2 dildos on the front page at the same time.

An EZFKA.com record, I think.

catching up to MB fast!

LOL!!

MB – who are they?

The hammer dildo is supposed to have 21 functions. I’m not seeing how this is possible.

Would you like me to show you?

But the reality is you can thank the modern microprocessors cheapness for the ability to create endless almost identical functions for your cheap electronic crap in software, such as the almost ubiquitous flash mode in led torches.

So, 21 steps of ass-buzzing intensity? why not make it a 3 speed? hi, lo, and medium?

Why would you only want 3 speeds when you can have random pulses, repetitive pulses, ramping up and down in triangular and sinewave patterns. It can even vibrate how hot you are in morse code if you want.

Or for a more accurate answer because people buy 21 function thingy over 3 function thingy if they are similarly priced. No matter how useless those functions are in practice.

“Most Dildo Hammers go to twenty. Mine goes to twenty one… it’s like one more, for that extra push over the cliff”

And just for some perspective, a statement from btcmarkets.net

If you do business with the shady muthafuckas stewie loves talking about so much then you are getting what you deserve IMHO. Crypto has attracted scammers left, right and centre but that doesn’t make crypto in and of itself a scam.

Speaking of dildos

https://www.afr.com/companies/media-and-marketing/a-melbourne-reporter-fights-a-guerilla-war-with-his-premier-20221108-p5bwii

you might have to 12ft.io it

really interesting inside look at how the media sausage is made in Australia

National Fairfax turning on the editors in Melbourne – even they can’t understand the hold that Dan has on their counterparts

dan Andrew’s seems like quite a frightening character

https://www.dailymail.co.uk/news/article-11410655/ABC-lashes-trivialising-article-describing-TV-reporter-making-TikTok-videos-going-gym.html

holy shit now the abc has their panties in a knot about it

The chinese binance guy CZ apparently couldnt sell all of his FTT ‘token’, so he’s in the hole for 4 or 500 million USD.

I’m not seeing this as some big masterstroke from him.

Cheers Stewie. Thank fuck I didn’t end up trading crypto. FTX was on my shortlist. I would have also purchased FTT to reduce brokerage fees.

Hi Freddy, glad you avoided doing your dough. These exchanges are fraught with danger. IMHO it was only a matter of time once SBF appeared on the cover of Forbes and started to be the darling of politicians. Elizabeth Homes of Theranos fame road a similar trajectory. Different, but the same.

I think I mentioned before how it was a good thing that SBF was Jewish as he’d probably end up moving Israel in order to avoid extradition laws. ‘SBF be in big doo-doo’ as Jar-jar Binks would say.

https://www.wsj.com/articles/sec-investigates-crypto-platform-ftx-11668020379

He might be making things worse for himself with these tweets.

https://twitter.com/SBF_FTX/status/1590709199067295749

What brought SBF down was the he couldn’t resist the wonders of financial alchemy, and the eternal fountains of creativity that spring forth from it. What will bring CZ down is corruption and regulation.

IMO the biggest take away from this is FTX US is fine. That is a subsidiary of FTX that was required to meet US regulations to protect US customers.

That brings us another step closer to governments controlling the very thing that was designed to avoid government control.

Thanks for these….I’m still determined to lose money on crypto!

It should pretty be easy to achieve that goal!

Apparently FTX US declared bankruptcy today – makes the rumours of SBF being arrested on the tarmac all the more interesting. If he doesn’t get to Israel or Switzerland (more likely Israel), he’s gunna end up in prison.

It is sounding like some other staff will join him in prison. Estimates that over a billion dollars of client money transferred out of wallets.

Whatever legal protections US clients had disappeared with a single passphrase.