Recently I’ve started to see advertisements for Crypto lending products, where you basically ‘loan’ your BTC to some crypto broker and they pay you a yield for the privileges of borrowing your HODL, with enticing offerings of up to 4% or 5%, which is pretty attractive when you are zero bound.

Unfortunately what you are buying is not an interest rate yield but a product that is embedded with credit and systemic risk that is likely to result in those taking up the offer to lose everything they put into it.

First up in explaining this it is necessary to start with the term structure of the Crypto market. Term structure means the pricing structure of both the spot asset and future assets prices (prices today and in the future), as derived from various pricing tools – mainly futures.

The normal state for any futures market is one of backwardation**. Backwardation is a pricing structure that starts with spot price (i.e. current price today) as being the highest, and then future prices of the asset tend to be lower further into the future (this is not strictly correct as we are really talking about convergence of future prices vs expected future spot prices, but that is more esoteric than I have time to explain).

Broadly the reason for this is the term structure of money and the uncertain of the future – money in the hand today is worth more than money in the future. Likewise assets needed today are generally more valuable than assets needed in the future. Commodity producers and manufacturers however like future prices, because it locks in production certainty, so they are often prepared to accept a little less than the current price today for their future sales, in order to guarantee production/funding.

A more unusual state in the futures market is Contango. This state occurs when the pricing structure of the commodity is upward sloping, meaning that prices in the future are higher than prices in the present.

Normally Contango as a state most commonly occurs in commodity markets when there is some form of supply dislocation. The most famous recent example was the crash in the Oil price last year ahead of the COVID lockdowns. If you had easy access to storage then an oil trader could buy oil now (or even be paid to take delivery of it) hold on to it in a salt mines or a large derelict oil tanker parked in the Philippines, while selling a future at a higher price to lock in a profit now. The only cost to the trader is cost of storage during the interim between now and the future that was sold and the date the oil would have to be delivered, and cleaning up any oil that might leak from your rusty tanker.

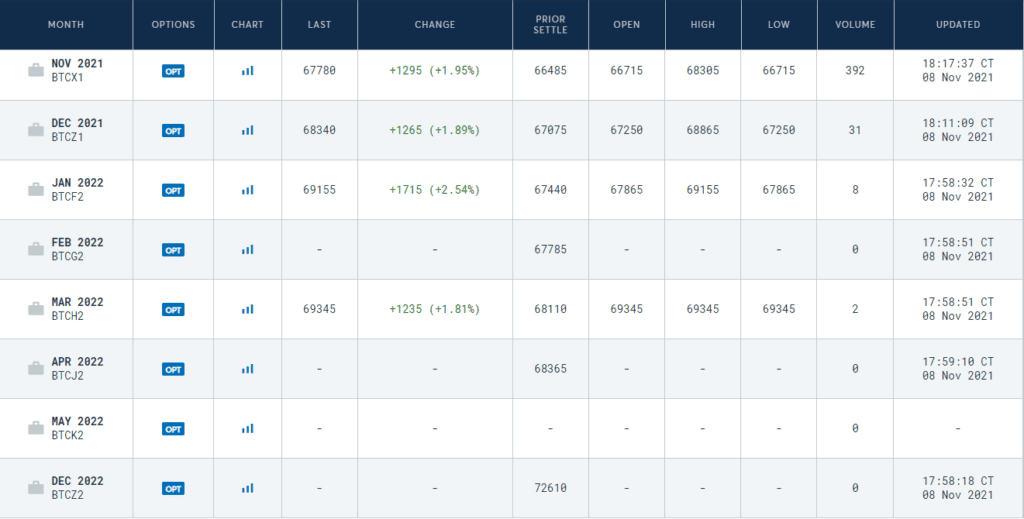

The futures curve for Bitcoin has been permanently upward sloping in Contago pretty much since inception, back in 2017 meaning that the price of the future asset is higher than the spot price of the asset for pretty much 4 years:

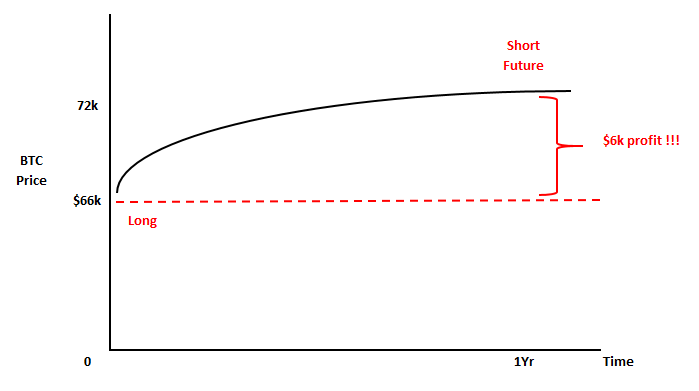

So here a ‘risk free’ arbitrage trade would be to simultaneously buy a BTC in the spot market for $66.5k (i.e. going Long) and selling a Dec 22 Future for $72.6k (going short), immediately locking in a risk free return of $6.1k for a yield of 9.2% – so long as no one cracks your wallet passport, not a bad return huh?

Nope! – the issue with financial assets is that they should NEVER go into Contango.

Firstly there are no storage costs for electronic money (crypto or otherwise). Secondly the whole market would normally rush in and buy the asset today and sell a future at a higher price to unload it in the future, locking in an instant profit – arbitrage. But, this action would quickly start to hammer the future price and pump up the spot price, until the arbitrage opportunity disappeared.

The implication that this arbitrage opportunity persistently exists and is not hammered by investors until it closes, is that there is some form of market dislocation or systemic credit risk that cannot be properly quantified or hedged.

In finance we spend a lot of time trying to understand the risks and one of the biggest risks is embedded counterparty risk or credit risk. We ask ourselves “Who ends up holding the bag?” The reality is that Finance is a Zero sum game – for every winner there is a loser, this is the reality particularly at the shallow end of the finance pond. The trick in the game is to make losers feel like they are winners, and one of the means of getting them into the trade is by paying them a yield to take on risks they don’t understand.

That said, if I am an unscrupulous trader and I want to grab that tasty futures spread without risking my precious capital how do I go about it? Answer – I borrow the stock.

But there is NO WAY any financial institution would lend money to guys trading on an anomalous BTC futures pricing discrepancy, whose main collateral is more crypto.

So this is where Celcius comes in – they are an enabler. Effectively a conduit or intermediatory that borrows crypto from retail and lends crypto to “Investors”.

“Celsius network are a community of over 1 million users that earn up to 17% yield on their crypto. Get paid in new coins every week and borrow cash at 1%”

…or so their marketing says. (17% in a zero bound interest rate environment screams credit risk to me)

The reality is that Celsius serve one purpose, to funnel money to traders wanting to capture arbitrage risk across different markets leaving them massively exposed to liquidity and credit risk. There is no other financial activity of note in crypto that can sustain this sort of activity and demand to borrow crypto.…. to be clear I’ll say that again, ‘There is no other financial activity of note in crypto that can sustain this sort of activity and demand to borrow crypto’.

If you want to spend some time combing through Celcius’s website you’ll see that their business model is a little more complicated than just that. They have their own coin ‘CEL’ (ironically named when you consider that many of those involved in this will end up in their own cell) which is engaged in the same sort of Tokenomics that many tokens issued in space are engage in, which is really just Ponzinomics built around the liquidity constrained systems that exist in crypto and that I have explained previously.

Celcius do a little bit of lending to retail and have some dinky credit cards called CelPay connected to their CEL coins, but really their main business is borrowing crypto from retail and lending it to “institutional” investors.

Not that you would realise this by reviewing their website – it is full of attestations by retail customers and reviewing it would lead you to think that this is their main business, as I said – it isn’t. Their founder stated as much:

“Our business is to lend out coins to institutions,” Mashinsky said in an email to CoinDesk. “Celsius lends mostly to large institutions and sometimes to exchanges, both provide us with collateral.”

– Alex Mashinsky

To me the mismatch between the marketing, i.e. safe loans to consumers, versus the reality, lending to high risk traders, is misleading to the point of being deceptive.

Celsius claim to mitigate risks around their borrowing and lending by placing ‘conservative’ limits on leverage by applying prudential limits of 25%, 33% to a top LVT of 50%…. conservative you think until you remember that it is not uncommon for price decline by up to 95% to occur during crypto bear markets (Celsius was founded in 2017 – they haven’t endured or survived one of BTC’s famous bear markets). This is how they can make money on loans to you at 1%, you provide 4 times the collateral i.e. Borrow $60k USD place 4 BTC as collateral, which feeds into the next issue.

The other issue is that because these guys are completely unregulated from a Financial services perspective, they are also most likely involved in Rehypothecation (they actually admitted to it in this article).

For those who don’t know what rehypothecation means, briefly it occurs when a financial institution takes collateral that they have been provided on loans that have made, and then RELEND that collateral to other investors via new loans – essentially small scale credit creation increasing systemic leverage in the process. Some banks and regulated financial institutions engage in the practice, but it is essentially small scale for them and their capital reserves in other areas of their business generally cover these risks in aggregate.

This bring me to another Red flag over Celcius – their management. Celcius was founded by Alex Mashinsky, S Daniel Leon and Nuke Goldstein. Nuke is an IT nerd, Leon is a serial start up entrepreneur whose previously been involved in a range of small unimpressive start-ups (a chauffeur company and some low key IT companies mainly in pharma) while Alex Mashinsky who is also in IT achieved great financial success by pioneering VoIP (actually it turns out he wasn’t even a pioneer in this field although he did engineer a successful float of a VoIP company that later tanked to practically zero).

What is missing from this team is ANY financial markets experience. These guys are very clever, have had previous success, yet very little understanding of financial markets and the risks that they are engaging in… they are the perfect marks for someone like Jordan Belfort of the Wolf of Wallstreet fame.

So who are the “Wolves of Wallstreet” in this game? Well unsurprisingly one of Celcius’s main founding investors was ‘Tether’. Another ‘investor’ heavily involved in this space is FTX which is a Bahamian based crypto exchange owned by Sam Bankman-Fried…. who along with quantitative trading firms like Cumberland Trading and Alameda Research (which is also owned by Sam Bankman-Fried) would also be one of the main “Investors” borrowing these BTC.

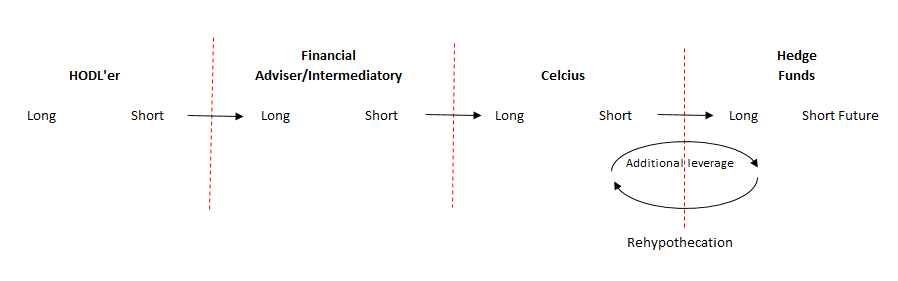

Okay, time for another little diagram to show you how people investing in these crypto lending products are going to be the bag holders when this business model eventually blows up (which I guarantee it will eventually do).

To start, look back up to the previous chart and understand that this is the position of the trader: Long BTC from borrowed stock, Short BTC via futures, and consider the retail HODL’er who is simply long BTC:

Basically the HODL’er starts long, they are holding BTC. When they lend their BTC to the financial adviser/intermediatory they effectively become short BTC, while the financial adviser/intermediatory they are placing their BTC with become Long BTC. These guys then lend it to Celsius, becoming Short BTC and net square in the process, while Celsius are then long BTC. Celsius get square by lending it to the traders and hedge funds (probably with several times leverage) who are then obliged to stake some collateral. Celsius then rehypothecate these coins, making new loans further increasing the leverage in the system.

This situation is likely to continue for some time. It is quite possible that it will last for several more years, although I doubt it – Celsius was founded in 2017, the same year that CME BTC futures went live. This is no surprise (and I might talk about it more in the comments below) but as there was enormous lobbying to get BTC futures onto the CME, rather than just relying on dodgy exchange futures like those offered by Bitmex, and would leak cash from their main liquidity constrained system (BTC). Celsius haven’t even been battle tested through one of BTC’s famous sell offs yet.

So yeah, this situation is likely to continue for some time, indeed the attraction of people seeking yield is actually likely to support the spot price of BTC for a time as retail investors buy BTC simply to then lend into these crypto borrowing schemes in order to earn yield. The problem is that as the BTC price term structure gradually increases, it requires more BTC to stake as collateral against the futures and steepen the Contango futures curve even further – hence the desire/need to borrow even more funds. Which is where the retail mug punter comes in.

What will happen at some point, because it always inevitably does, is that the Contango positioning of the BTC Future price will eventually unwind – if something is unsustainable, then eventually it must end. There is no magic pudding in terms of making money.

My personal opinion is that this systemic risk, as represented by the permanent state of Contango, is a function of the systemic risk that exists with Tether and the fact that real institutional investors have no desire to take on the unknown credit risks that exist in the market due to the lack of genuine price discovery that Tether’s actions result in.

The leverage and positioning used in this way all but ensures that when this event eventually occurs it will be non-linear and asymmetric. Supposed hedging relationships will blow up, either because correlation breaks down, or the complicated financial plumbing that exists between Celcius, other financial providers and the “Investors” becomes clogged – the recent experience of Robinhood and the Game Stop debacle is a good example.

Then traders based in the Bahamas will simply disappear, Celcius’s rehypothication and collateral lending schemes will implode the moment the SHTF and BTC drops 80%, becoming insolvent in a flash. Losses will then flow back down the line until the eventual bag holder, the mug punter Hodler cops it in the nuts.

This BTC futures spread isn’t the magic pudding – people haven’t discovered a risk free way of making money. This spread is essentially a form a concentrated systemic credit risk and HODL’ers investing in this product are not buying a lending product, they are buying embedded credit risk disguised as yield.

I have no problem with people buying crypto and being exposed to price and volatility swings. This is what is to be expected and people buying crypto should be under no illusions that they are exposed to massive price swings. But at the end of the day they will still own their BTC – whatever its price may be.

What I have an issue with is people taking on risks that they don’t understand – they think they are getting a low risk yield, but the reality is they are taking on enormous and undefined financial risks at the far end of the above flow diagram and are likely to lose everything they put it, losing out not only on price, but their entire collection of BTC’s in the process.

If you are wondering if this sounds familiar it is because it is. This is near EXACTLY the same business model that existed in the GFC, where embedded credit risk was passed off to retail investors (and dumb institutional investors) in the form of CDO’s and other similar products.

When and if you see any institution advertising an attractive yield for borrowing your crypto then just think of Basis Capital – google it to find out how a pair of smart guys thought they had discovered a risk free way of making money, and bought equity tranches of CDO issuances that Goldman Sachs and the likes were unloading as fast as they could. Basis then farmed out the risks that they were taking on to a whole heap of unsuspecting retail investors via their financial advisers who thought they were buying an interest rate product. Those retail investors lost their entire investment.

These two doofuses from Basis Capital thought they were ahead of the pack, but the reality is, when you are the smartest guy in the room – chances are you are the only guy in the room.

**Edit: I received some valid criticism from financial market types on my stereotyping of Contango as being an abnormal market condition. This is fair enough, to avoid complicating the underlying issue for the everyday reader, I deliberately ignored carry and used spot as a proxy for future spot without wishing to complicate it further by bringing in forward curves and running through complete pricing attribution. Truth is some mild upward slope in future prices is actually a normal futures pricing curve for many commodities (and some financial products). This slightly positive slope reflects the embedded storage and finance cost charges, i.e. “Carry” e.g. hire of oil tanker. However I was trying to keep it simple in order to highlight what imho is a genuine super contango pricing structure built around ponzinomics and not simply a normal futures curve reflecting the supposed ‘new normal’ of market forces unique to crypto.

Mashinsky, Leon, Goldstein, Bankman-Fried

etc etc etc

I thought these names would be enough to get alarm bells ringing on their own , especially for you Stewie

again thank you for this but the greatest tragedy of crypto is that you (and others) waste their time and intellect confirming that an obvious scam is in fact a scam

LOL – the great tragedy is that DLT really does work and is useful at solving the micropayment problem. However the well of public opinion is being permanently poisoned with the the idea of public blockchains and the obsession with “Number Go Up” and “Store of Value”.

The claims of those spruiking this path will never be met, but the real tragedy is that this false narrative is impeding the far more humble and boring path of adoption in solving the problems that it was designed to solve.

Glad you liked the article though – many, many people are going to be burned by these lending schemes. Both Celcius and BlockFi (the other “Crypto Bank”) are BOTH now being investigated by the SEC.

https://markets.businessinsider.com/news/currencies/blockfi-high-yield-accounts-crypto-sec-investigation-coinbase-gensler-2021-11

regular Money already works very well for micropayments

Not for IoT nor for small casual per to per payments. Every electronic transfer you make costs around 1.5c, even if you don’t actually end up paying it up front it gets built into the service charge.

That sounds like a solution for a problem that does not need to exist. IoT is a nice idea to make one’s life sweet and complicated. Life existed million years without internet, it can sure continue well without IoT, dare I say even better without it.

small peer to peer payment has a perfect solution: cash.

In my view digitisation of payments and money is mostly to enable taxation of every micro segment of payments.

Except it doesn’t actually cost that for the things that micro payments actually get used for in the real world currently such as ads on web content, video streams, audio streams and the like.

Stewie, a few years ago I worked in payment processing for a couple large banks. The only threat they saw in crypto was cutting out the ticket-clipping banks particularly for international swift payments.

On that point, it seems the crypto exchanges have simply replaced the banks as the ticket-clipping middle man so no real gain. Am I missing something?

DLT can reduce transaction costs to hundredth’s of a cent and cut out an enormous amount of middle men that take their cut. Banks are well aware of this and there is a huge amount of effort going on behind the scenes to get ahead of it and incorporate the tech into their existing payment structures, while the rest of the industry is distracted with the ‘store of value’ nonsense.

The future of finance is going to be carried out between two API’s. What DLT offers is to replace all the financial plumbing that would currently exist between two entities carrying out a transaction to simply, API-DLT-API.

Banks and existing payment providers know this – Mastercard are one of the biggest patent holders in this space and are on a huge recruiting drive in this space.

As for Crypto exchanges – imho they are going to go the same way as Blockbuster. Once (if) scaling is overcome, the first DLT that solves the problem is going to consume every other chains use case reducing exchanges role to buying and selling one crypto against fiat. Not going to be much money in their for them, hence their opposition to chains that may potentially solve the problem.

The crypto industry as a whole, and indeed even some use cases proposed on the more efficient DLTs, are little more than Rube Goldberg machines, solving existing problems in more inefficient ways. Like Pet’s.com and the internet, DLT isn’t applicable to every use case, I am very much a realist here and probably talk down much of the excitement that exists elsewhere in the industry..

Stewie there is no real world example where these need to be CRYPTO transactions

they can be centralised and non trustless , then accumulated into one larger fiat/SWIFT transaction

Of course there is no need, but if the future state model is API-DLT-API which delivers the solution at a lower cost than the existing financial plumbing network, then economic incentive will drive adoption.

I will concide that there is a big IF at the start of that statement.

It’s physically impossible for a trustless decentralised ledger to be more efficient energy wise than a centralised database

and completely unnecessary

Then we have a market!!! 😉

But what stewie advocates is effectively a trusted central ledger hiding in crypto clothing…

Bjw, you’re not dead! Yay!

how ya been?

Busy back at work. We need a new plague so I can work from home again…

I also tend to skip the satire stuff, doesn’t really encourage interesting discussions very often.

im sorry to hear that. Here’s hoping!

LOL – love your tenacity! Welcome back 🙂

IMO the increased competition and lower transaction costs are only a temporary phenomenon. The banks will use the existing playbook of convincing government to increase regulation which will wipe out the smaller exchanges. They will find a way.

From a government perspective the only advantage I see is the information attached to the ledger itself. An an example, it is very easy for drug dealers to pay cash to a bunch of plebes to wash the money through casinos or other fronts. There is no escape if all the transfers are recorded on a ledger.

DLT’s solve the problem with Global ledgers – you can build financial systems that are universally balanceable at any moment. When 24/7 trading arrives it will be on DLT. DLT’s do solve problems.

Bitcoin as per its original White Paper was fully semi-anonymous yet legally compliant because of the chain of signatures and traceability. It is the WORST means of carrying out illegal transactions.

People forget that the creator of the White Paper use to work in the gambling industry and was partly motivated in his development of Bitcoin to solve the issue of electronic money and the full auditability that online gaming laws require.

Great article. Lots of food for thought. Your comment here has my spidey senses especially piqued.

I have often had a feeling that some of the “seemingly” more promising blockchains have been “opposed” or even straight up price suppressed, in favor of ones that are more a popularity contest on socials, despite being less capable.

Do you have any specific projects in mind for which this could be the case?

Thanks!

I share some of your views and have elaborated on them in some of my previous articles.

“DLT can reduce transaction costs to hundredth’s of a cent and cut out an enormous amount of middle men that take their cut. Banks are well aware of this and there is a huge amount of effort going on behind the scenes to get ahead of it and incorporate the tech into their existing payment structures, while the rest of the industry is distracted with the ‘store of value’ nonsense.”

and thats why ripple (with XRP solving that problem) is under trial by the

BanksSEC.Good red thanks.

Quick question for someone who has just literally started trading crypto – which hardware wallet do you recommend?

I’m split between the Ledger and the Trezor and unsure if there’s any major advantage to either. Both seem durable.

I don’t use either – I have cold storage devices maintained offsite that I might access once every six months max. I’ve heard mixed reviews on both, but that’s probably more due to my obscure crypto tastes.

This is a great write-up!

Thanks for a the write up Stewie. Good to have something break up the satire posts 👍

Cheer’s T/DD.

I’ve been doing a bit more research subsequently and came across this piece by Professor Carol Alexander, who examines a similar collateral lending path to the one that I propose, only her analysis focuses on the role collateral plays with Tether and USDC.

https://www.coalexander.com/post/the-bitcoin-ponzi-ecosystem

(it is a little more technical than my attempt, but along the same lines)

Personally I see both as being equally plausible IMHO there is no way that Almada aren’t trying to grab some of that Contango spread. They are perfectly positioned to take it on.

Firstly they are professional Arbitrageurs and would be well aware of the Contango. Secondly as they control exchanges and have established conduits into fiat via USDC they have the ability to monetise their collateral and meet the cashflow payments that would be associated with any margin movements on the USD futures.

Personally my own opinion is the nearly the entire crypto industry is an example of decentralised control fraud. Where every major participant is carrying out their own scam/business, and is individually aware or knows what the other is doing and the fundamental lie that their entire industry is built on ie Tether, yet each continues to play their own part in the scheme in order that all may profit.

LOL – just took a further look at the Celcius website. To illustrate just how ridiculous their business model is, check this out.

I can borrow $58k from Celcius (which is equal to 1 BTC) by depositing 4 BTC with them (or around $432k), for which I would pay 1% interest.

I could then use that $58k to buy one BTC and then loan that additional BTC back to them, and earn between 3.05% to 6.20%…. so you are effectively being paid between 2.05% and 5.20% in order to take out a loan with them. The whole premise is so fucking ridiculous that I can’t believe they’ve gotten this far without blowing up yet.

Magic pudding indeed

now you just need to make your interest payments tax deductible in Australia as an investment , and your interest received through a British Virgin Islands zero tax company

it does seem as a ponzi, isn’t it?

Yeah it is weird…but when I think it through this part seems to make some sense…if they have 4 BTC to rehypothecate and they use say 2 of them and can earn 6% on each, then effectively it doesn’t matter to them what you do with the money. If you decide to buy BTC with the loan, you’re just taking on leverage right? It just puts you at higher risk of being liquidated if BTC goes down because you’ll have less money to pay the loan back, at which point they would own your 4 BTC and you would be left with 1. Provided the price doesn’t drop more than 75% before they take action, as far as I can tell, they wouldn’t have lost anything?

You would be paid for taking out the loan as you say, but you’re taking on more risk and not earning any interest on those 4 BTC you put up as collateral which would be getting you more than x4 as much interest. Seems much worse to take out a loan as you then take on more risk and earn less interest, whilst Celsius would earn more interest from the additional and potentially have 2x (assuming they don’t rehypothecate more than 2 BTC) the safety net than otherwise.

I actually think the 1% interest for 25% LTV is really not as great as it sounds and massively beneficial to them. I’m sure if you compensate for the collateral required, the loans would not be much better of a deal compared to more traditional routes.

Does that make sense?

Completely – that is 100% their business model with the retail side, and that Celcius are gouging them with the over collateralisation vs the rates they are paying (I will admit their insto lending is much more of a black box).

I’m not saying this model wont work for a time, I’m just saying it won’t work all the time, and when it gets thrown into reverse, these structures and flows tend to unravel all at once, often destroying the liquidity needed to unwind them without loss in the process.

The big risk lies in the black box model of their insto lending, and the assumptions underpinning their lending and ability to reclaim their funds and if necessary liquidate them in a time of extreme volatility.

Clesius retail lending to retail via CEL and cash, is really just a crypto conduit to the big boys with whatever crypto they stake as collateral. It gives Celcius access to more crypto to loan out.

great article. I always understood that these people who borrow their bitcoins carry risks, but I could not understand which ones, and now I understand. super article

Thank you, interesting read. I am a Celsius user, but will likely move my coins off it soon.

You stated that Celsius hasn’t endured a sell-off. I take this to mean you do not consider May 2021 (where BTC fell to ~50% of the – at the time – all-time high) to be a sell-off. That’s surprising.

Could you explain your thinking here? How large a sell-off would need to occur for that statement to apply no longer?

Thanks

Hi, none of what I have written should be considered financial advice. This was just my opinion in respect of market conditions and business models that I have been struggling to understand due to their black box nature, and dependence on flows associated with Tether and the entities that control it.

In most markets a 50% fall would be considered to be an enormous test, however it is not uncommon for crypto markets to fall by more than 90%. Also the last significant systemic event to occur in crypto was probably the failure of MtGox. Given the prominence and importance of Tether in crypto and the significant financial questions that surround it, I remain skeptical of ALL businesses, including many exchanges, involved in crypto until that systemic question is resolved.

My only advice is that I’d strongly recommend you obtain independent financial advice before taking any actions, and view my commentary as speculative opinion only.

The mythical independent financial advisor.

As you know I am researching crypto trading. Even fairly profitable trading systems have frequent 40%-60% drawdowns. The volatility is so crazy that 50% is just noise, and cannot be compared to the 20% definition for a stock market correction.

Aye… in reality any financial advisor will only really ever recommend some index funds, property, super and insurance.

you’d have to search far and wide to find one that knows anything about teh crypto…. And those that do would hardly advise you to touch it, I expect.

much safer just to recommend super, property, index funds 🙂 money for jam.

Unfortunately, after 30 years of MOAR there are only those types around. Every other financial adviser or fund manager has become extinct.

For the life of me though, I cannot see crypto as anything other than high risk speculation. As Stewie says they are nearly all in the Bahamas. Even something like Coinbase that is US regulated with bank guarantees etc is at the mercy of US government tolerating crypto. Then fuck knows what is actually backing Tether, and if those rumours are true about fake Tether being printed to prop up crypto prices.

It has a bit of a dotcom feel about it where everyone “knew” the future economy would be driven by the internet but nearly everyone backed the wrong horses with Netscape, Yahoo, and all these other highly speculative stocks. It took years for the FAANG stocks to emerge as contenders and some of those will inevitably drop off as well.

100%

+1

Thanks for the response, that all sounds reasonable.

I should have said that my decision to stop using Celsius was more due to last week’s reduction in their lending rates – was just adding that for context rather than drawing any implication as a result of this article.

All good.